3 Vital Stages To Create A Winning Investment Pitch

12th November 2020

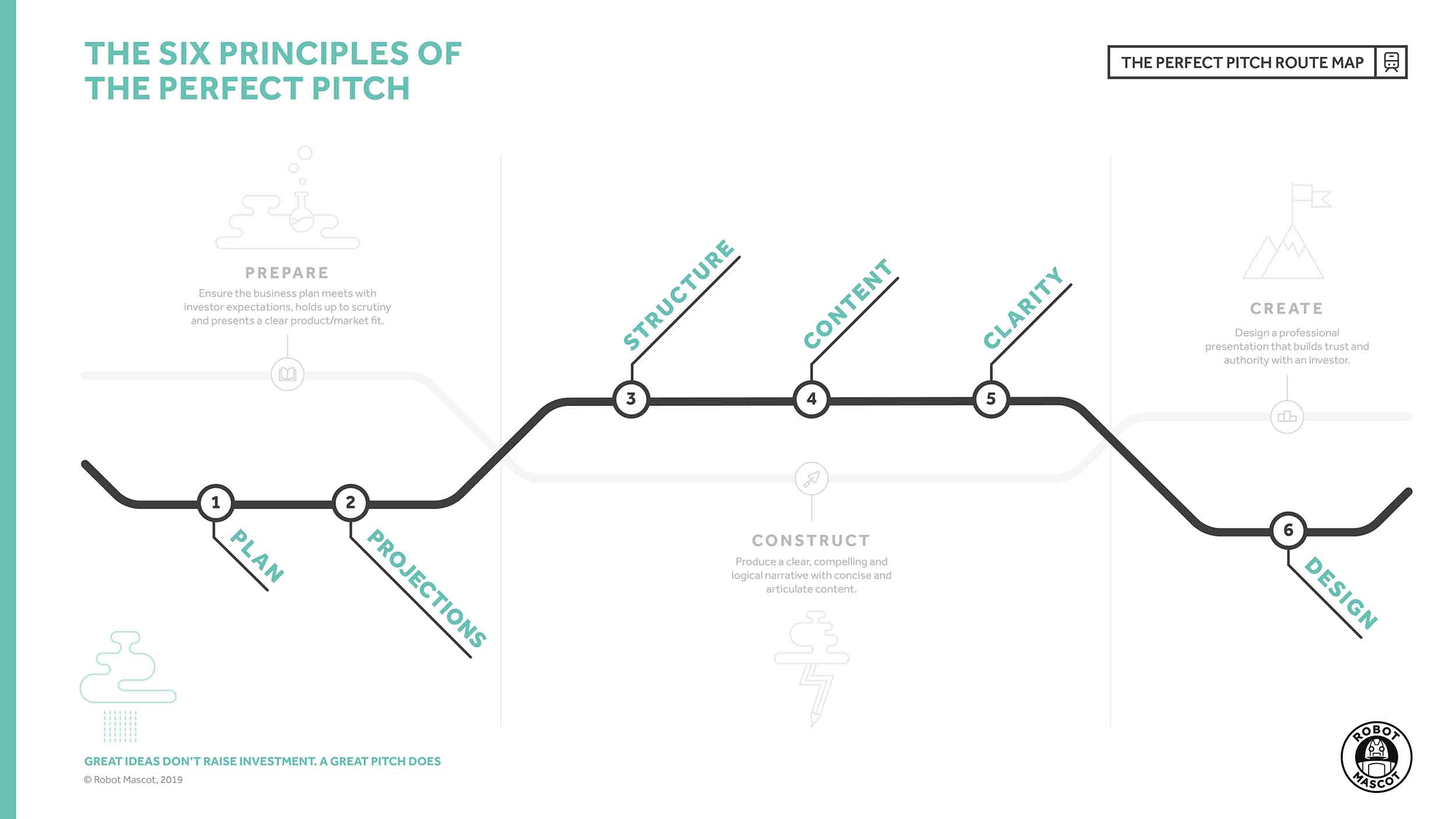

If you want to create the perfect investment pitch to position yourself as a genuinely investable entrepreneur, you need to follow a very precise process. There are three critical phases to crafting your investment pitch, and within them are contained six principles, which together add up to pitch perfection.

Many entrepreneurs embark on their Fundraising Journey without discovering there’s a tried-and-tested method to pitch construction. Those people are likely to struggle as they won’t have followed the formula for pitching success. However, once you know the steps you need to take, you can follow a logical, comprehensive path and arrive with an investor pitch that’s compelling, robust and investor-ready.

Download the Six Principles of the Perfect Pitch method

Today, we’ll give you an overview of the three critical phases of creating a perfect investment pitch so you can understand precisely how to navigate this part of your Fundraising Journey.

Phase 1: Prepare

In the ‘Prepare’ stage, your job is to assemble all the evidence that proves your business idea is viable and credible. If this is your first round of investment, much of this work will have taken place during the bootstrapping phase of your idea, where you tested an MVP, identified your target market and completed research into consumer demand. If this is a later stage round, you will be leveraging your commercial successes to date. Everything you’ve learnt forms the groundwork for two of your critical fundraising assets – your water-tight business plan and an accompanying set of financial projections to back it up.

These two pieces of collateral are vital to your success, so they need to be well-researched, evidence-based and crystal clear. At such an early stage in your business, it might be challenging to come up with something that feels like credible financial projections and a believable business plan, as perhaps you feel that you don’t have enough data to base them on. This is often where external support can add real value.

At this stage, you must be considering all the questions and concerns your potential investors could have. Entrepreneurs who don’t do their due diligence and turn up with a business plan and projections that they can’t substantiate will quickly come unstuck. Investors will scrutinise your business plan, they’ll demand to see validation and evidence of product/market fit, and they’ll have expectations about what you can achieve and when they’ll see a return on their investment. During the ‘Prepare’ phase, you must ensure you can address their concerns and have all you need to back up any claims or assumptions you are making in your pitch.

‘Plan’ and ‘Projections’ are two of the Six Principles of the Perfect Pitch and they are the foundation on which you build your pitch. Getting them right at this first stage is vital before you move on to the next phase.

Phase 2: Construct

Having done all your foundational work in the ‘Prepare’ phase, it’s time to construct your pitch. Boiling down your business plan and financial projections into a tight 15 – 20 slide investor deck is going to be a challenge. However, without a concise narrative that communicates your vision and how you intend to make it work, investors will switch off. They don’t have time to wade through muddled or confused pitch decks trying to figure out if there are any hidden gems. Make it easy for them to understand what you want to do, how you intend to do it and what’s in it for them.

Ideally, each of the precious slides should contain no more than 100 words (ideally less than 75), which is tough. But remember, in this phase you are putting together written content that will see you through your investment round. It’s worth investing your time and resources in getting this spot on, you may want to work with a professional pitch writer to ensure every sentence delivers value and no words are wasted. Remember, if your investor pitch is absorbing, exciting and memorable, you’ll stand out from other opportunities on offer.

Three of the ‘Six Principles of the Perfect Pitch’ are deployed during the construct phase – ‘Structure’, ‘Clarity’ and ‘Content’. Don’t subject yourself to disappointing investor experiences because you haven’t taken the time and care to get this right. Your content must be strong, there needs to be total clarity in your messaging, and everything must be well-structured and accessible. By constructing a narrative that ticks all those boxes, you can inspire investor confidence and get them excited about your vision.

Phase 3: Create

Once you’ve got the written content right, it’s time to add in the visuals. It’s not enough to produce an investor deck with the odd graph and photo – remember, great design will bring the information to life. The combination of razor-sharp copy and strong design will elevate your pitch to the next level, and there are many ways to represent the information contained in your pitch copy visually.

At Robot Mascot, we use a range of information design choices including typography, diagrams, imagery and infographics to create client pitch decks. Often the visual representation of a point will stick in the mind as investors can easily conjure up the image, where verbal or written explanations are harder to recall. However, you can’t just throw a ton of visuals down and hope they stick.

Like your written narrative, your design must be coherent and consistent to build a brand image that promotes trust and authority. By developing a unique design style, you can further develop your brand identity and reinforce your key messaging. There’s a reason why ‘Design’ is the last of the ‘Six Principles of the Perfect Pitch’ because it’s the final, vital touch to make sure your pitch is on point and investor-ready. From here on, you’ve got everything you need to go confidently into pitches and wow investors with your proposition.

Learn how to convince investors

Investable Entrepreneur takes you through our winning methodology – the process we use to increase our client’s chances of raising investment by more than 30x.

“This book will help you translate your entrepreneurial vision into something investors can get behind.”

Daniel Priestley, CEO and founder, Dent Global and four times best-selling business author

Keep up to date with what we’re up to via email

Copyright ©Robot Mascot Ltd. All rights reserved.